Sustainable Energy Investments for a

Resilient Future

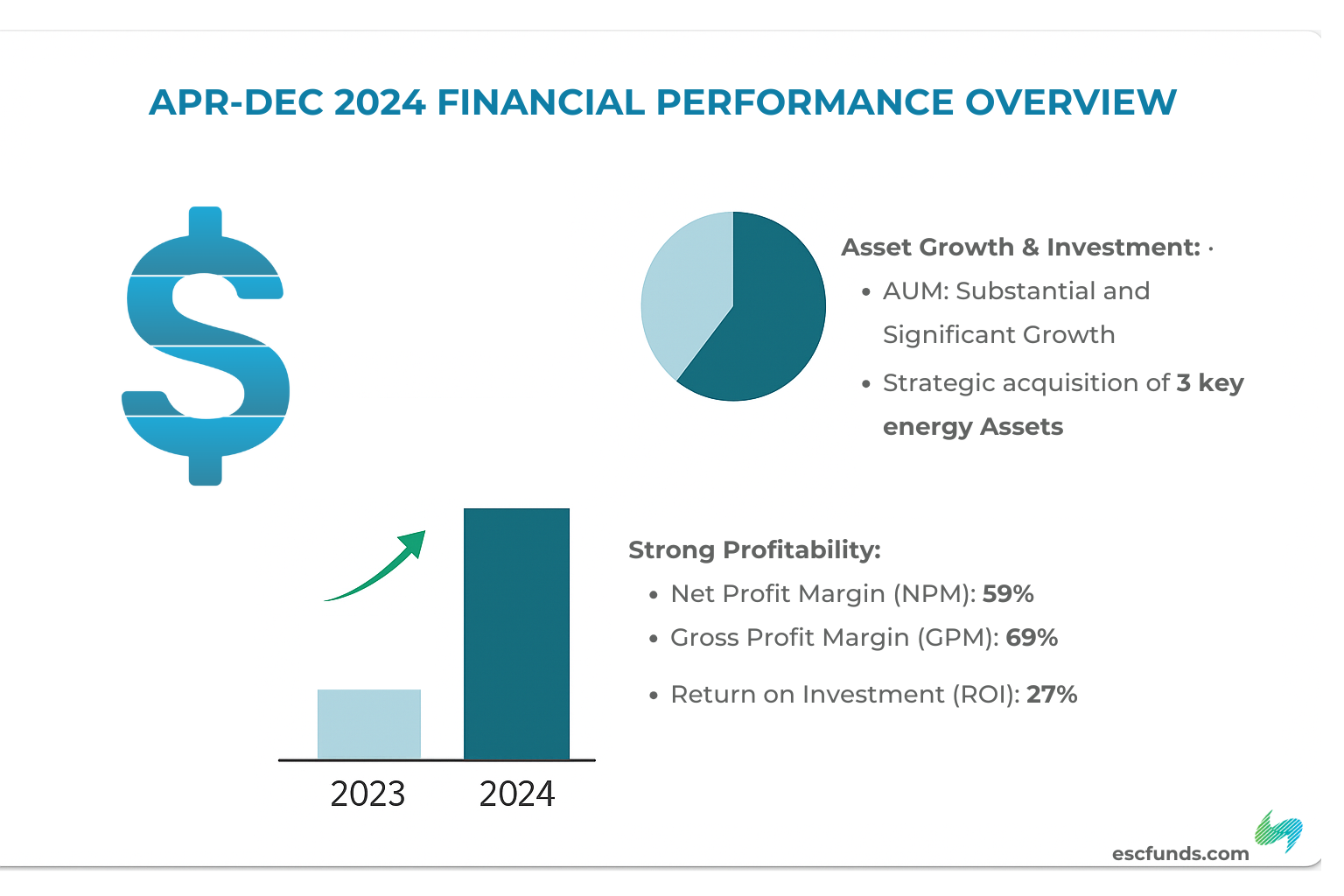

Driving Growth in Oil and Gas Through Sustainable Innovation and Capital Efficiency

The ESC Story

The vision that drives ESC delivers strong returns, actively contributes to a sustainable future, and assets optimization.

Our story begins with a deep understanding of the energy space, forged in the demanding world of oil and gas operations. This is based on hands-on experience that gives our expert fund management team an unparalleled edge. We know how to identify inefficiencies, optimize assets, and unlock hidden potential in building a sustainable energy future.

Think of us as energy fund domain experts and strategic navigators, guiding capital towards high-yield and high-impact opportunities. Under the umbrella of Energy Sustainability Capital (ESC), we’ve established specialized funds, each with a distinct mission:

- ESC Income Fund LLC

- ESC Growth Fund Inc

Our Investments

At ESC, our investments are strategically designed to deliver strong financial performance while advancing sustainability in the energy sector. We focus on capital-efficient opportunities across traditional oil and gas, transitional infrastructure, and clean energy innovation.

ESC Income Fund LLC

Invest in the long-term value creation of ESC through reinvested income and potential capital appreciation in our expanding energy portfolio.

ESC Growth Fund INC

Receive regular income through quarterly dividends from our portfolio of producing oil & gas assets. Designed for investors seeking recurring returns.

Trusted By Investors

The energy space is evolving, and at Energy Sustainability Capital (ESC), we are at the forefront. We specialize in the acquisition of producing oil & gas assets in Texas, optimizing their performance to generate consistent cash flow.

This disciplined focus on tangible assets allows us to deliver dependable dividends, offering a compelling blend of financial growth and contribution to the energy infrastructure.

Our Benefits

Superior Passive Income

Access multi-year income streams designed to consistently outperform S&P 500 dividends.

Exclusive Energy Ownership

Gain fractional direct ownership in high-potential private oil & gas and broader energy assets.

Optimized Risk-Adjusted Returns:

Target compelling returns driven by a strategy focused on mitigated risk within the energy sector.

Strategic Market Timing

Capitalize on a uniquely positive current environment and robust long-term outlook for the energy sector.

Join Our Investor Network

Exclusive Access to Market Insights, Reports & Strategic Opportunities

Partner Insights

ESC’s approach blends engineering insight with a genuine commitment to sustainability. Their ability to transform legacy oil and gas operations into efficient, future-ready assets is exactly what modern energy investing needs. ESC brings deep industry insight and a fresh perspective on what energy investment can be. Their ability to merge operational know-how with sustainability-focused innovation is unmatched. We’ve seen both financial growth and real environmental progress.

— Institutional Energy Investor

Partnering with ESC has been a game-changer for our portfolio. In a time when energy markets are evolving fast, ESC provides stability and upside. Their smart, sustainable approach to oil and gas investment gives us confidence in both our returns and our impact.

— Portfolio Manager, Energy Sector

Latest News & Insights